|

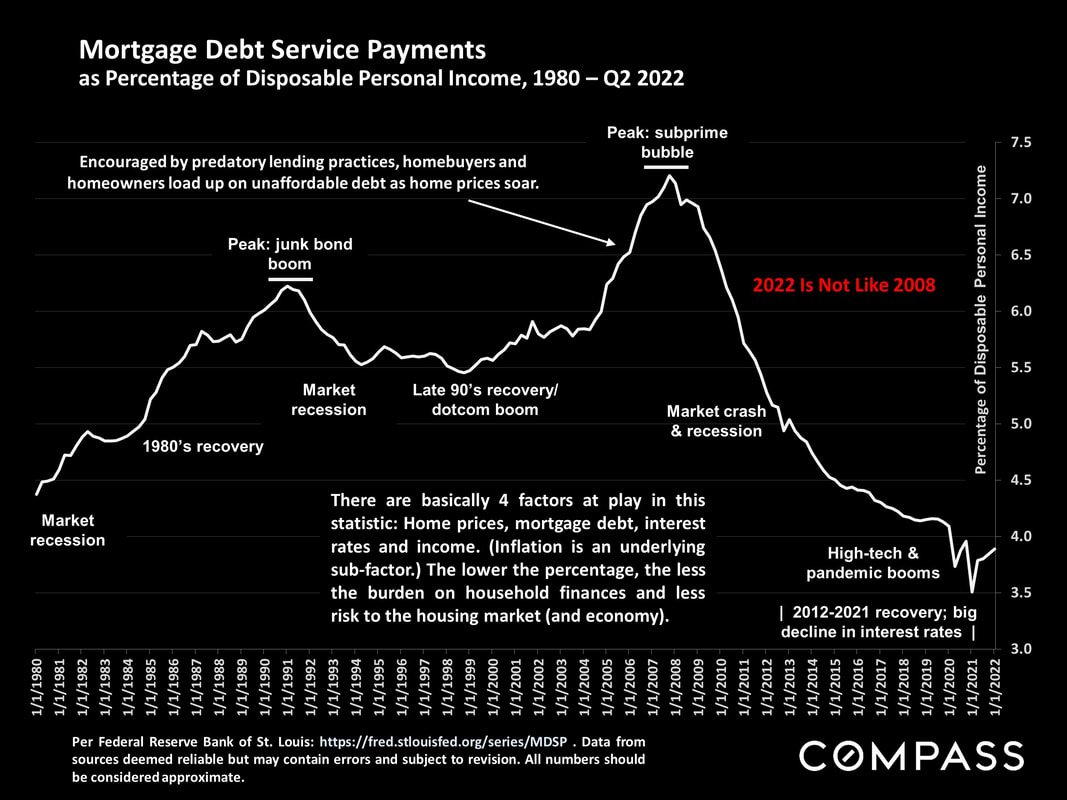

Even the hottest markets eventually cool. This does not necessarily imply a large “bubble and crash” (terms much overused). Over the past 4 decades, a cooling shift has typically meant a gradual decline in sales activity, then either a leveling off in appreciation or price declines of 5% to 10%: More like a slow leak in an over-pressurized tire than a blowout at high speed. The 2008 subprime crisis – a true bubble & crash – was an extreme event brought about by a massive failure of ethics, underwriting standards and risk management in the loan, banking, investment and ratings industries. A correction is not a crash. The precipitating factor in the 2008 crash – tens of millions of households talked into home loans they couldn’t afford, forcing frantic sales during a recession – does not apply today. Indeed, mortgage payments as a percentage of income are close to all-time lows (and most homeowners’ mortgages are also at historically low rates). Outside the 2008 crash, market corrections over the last 4 decades typically ran from a simple flattening in appreciation, to price adjustments of 5% to 10% (relatively small compared to the appreciation rates which preceded them). This chart below is in the macroeconomic indicators report. Staggering levels of unaffordable mortgage debt was a huge factor in the 2008 crash, but right now, the current level of mortgage debt as a percentage of disposable income is close to an all-time low. A tsunami of foreclosures and short sales behind the home price crash in 2008-2011 is not imminent: Here is a quote from the San Francisco Chronicle (July 2022) "The 2008 collapse was an anomaly. The 2005-2007 bubble was fueled by home buying and refinancing with unaffordable amounts of debt on a staggering level, promoted by predatory lending practices, promises of endless appreciation, and an abysmal decline in underwriting standards — and then eagerly facilitated by smug, rapacious, Wall Street flimflam and self-abasing credit ratings agencies, Millions came to own homes they could never afford to pay for and the rot was distributed throughout the financial system.”

We can't predict the future...there are indeed many volatile economic, political, demographic and even environmental factors at play right now. Certainly, the housing market has been going through a significant correction since June of 2022. As long as home loan interest rates continue to rise, this correction is likely to continue into 2023. Pete Sabine & Leslie Whitney Call or Text 925.787.2548 [email protected] OurFiveStarTeam.com Compass License #00889760 #01950037

0 Comments

Leave a Reply. |

AuthorPete Sabine Archives

January 2024

Categories |

FIVE STAR REAL ESTATE TEAMRepresenting homeowners & buyers since 1985 with local real estate expertise and over 1000 successful real estate sale transactions, including Buyer Representation, Homeowner Representation, relocation transfers, Investor Representation and professional staging services.

|

COMPANY INFOSan Francisco

East Bay CONNECT WITH PETE

|

OFFICE LOCATION |

QUICK LINKS |

HOME |

ABOUT OUR TEAM |

BUYING |

SELLING |

COMMUNITIES |

TIPS & TOOLS |

CONTACT |

© PETESABINE.COM | PETE SABINE DRE#00889760 | 201 Lafayette Cir #100, Lafayette, CA 94549 | COMPASS DRE #01527235

Site by WPF Creatives

Site by WPF Creatives

RSS Feed

RSS Feed